Is FAST a micro or macro play?

It has been the mantra since FAST started its explosive growth that this new business model was an opportunity for smaller content owners to quickly produce channels that could be exploited in the new linear space in a way that could never happen before. Single IP or genre specific, the ability to target niche audiences with content that has been languishing unseen, has been seen as the nirvana for the “micro” end of the content factory.

However, I am not sure that this is going to remain the case – FAST as proven itself as a business model to the big name “macro” players, who are now looking to scale up their own offerings, bringing more of their premium content to grow their own propositions and use their existing relationships with the CTV and other FAST platforms like Vizio and PlutoTV to secure more prominent positioning on the fluid EPG ecosystem – something which both sides will see as beneficial. With macro FAST channels from the leading M&E businesses like ITV Studios, AMC, and BBC Studios in play, the EPG positions/numbers for the micro players is going to come under greater scrutiny from a commercial perspective. In a world driven by revenue share and inventory swaps, will the niche players be able to deliver as significant a return to the platform hosting the channel as the macro behemoths that are now waking up to FAST as a mainstream distribution methodology?

What’s in this for the macro players then – isn’t this just a repackaging of the linear business that we have spent the last ten years moving away from?

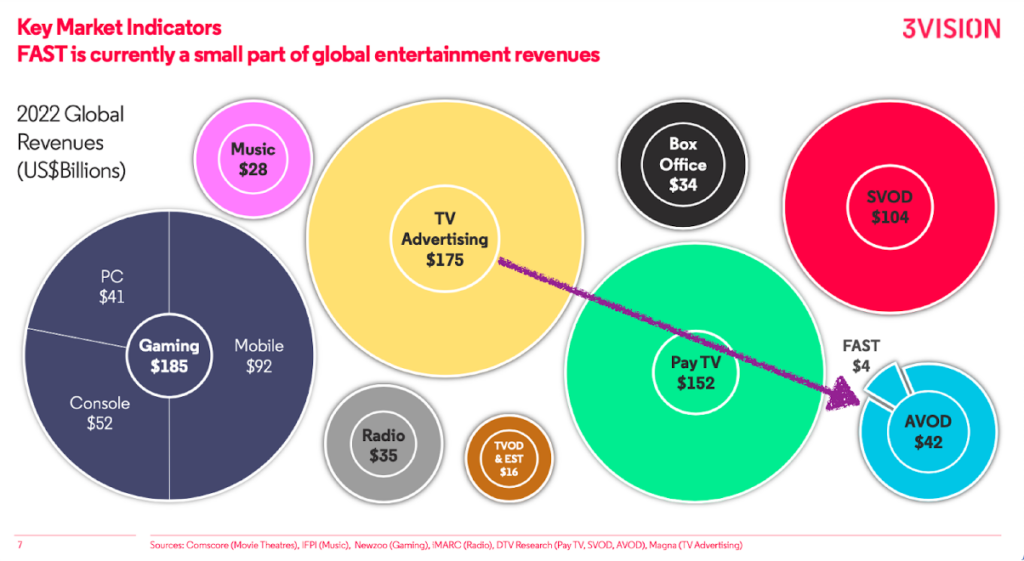

I will hold up my hand and say that I have been as guilty as anyone in our industry bubble in saying that VOD is the way forward and that linear is so last century. The truth (and the revenue) is a lot more nuanced than that – have a look at this fabulous chart from our friends at 3Vision.

We will all be going FASTer

Globally, FAST and the wider AVOD business is just 26% of the “boring” old traditional linear TV advertising revenue that the industry has grown on.

The purple arrow is mine – I see a world not too far away, where the majority of linear content is delivered unicast over IP. Once that is the delivery mechanism, ALL of the mainstream linear channels will move to a macro super FAST model, with the majority of the sold advertising being personalised at a household level at least, with a commensurate increase in CPM. With that draw in place, ALL of the M&E giants will want a piece of the FAST EPG action, making FAST proposition even more attractive to TV viewers

Underpinning all of this revenue will be a need to understand how content is being consumed and what revenues need to be associated with content – this is true whether you are in the micro or macro pond, and this can only come from automated reporting and analytics across all distribution platforms. This is an area in which Whip Media excels and the team at MIP will be able to show the reporting and royalty solutions that we have in place for all of the macro and micro players, and AVOD/FAST platforms that I mentioned above – but you better move FAST.