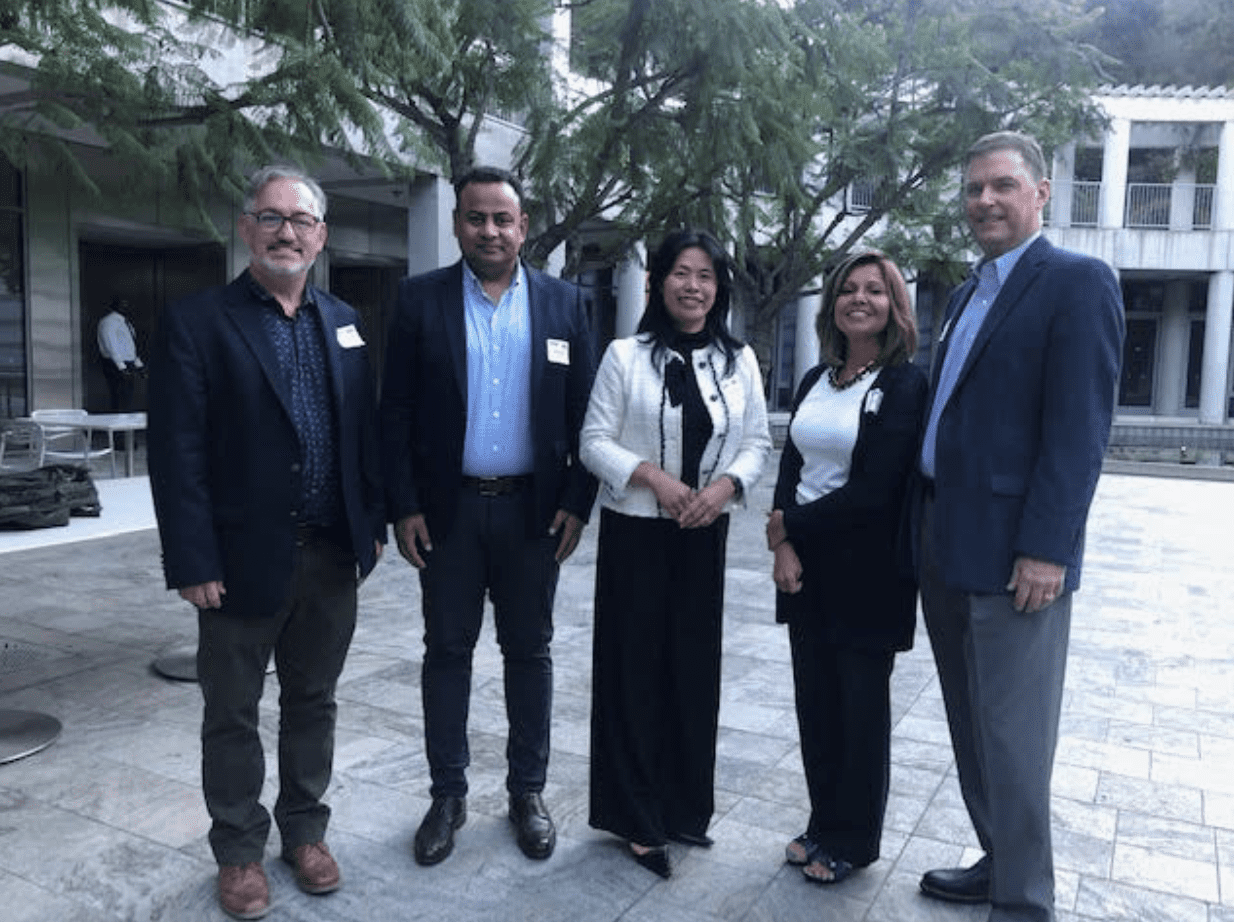

Panelists, from L to R: Scott Byrne, EY; Ashok Parmar, Deloitte; Margarita Lam, Point B; Deborah Newman, Grant Thornton; and host Joe Annotti, MFM.

Whip Media was proud to sponsor an event on October 18th hosted by MFM and DEG that brought together a panel of media insiders to discuss a wide range of issues facing the industry. The discussion covered the growth of streaming, the emergence of NFTs and the metaverse, risk management, what’s ahead for industry regulations, and ultimately what it all means for media and entertainment industry financial professionals.

The panelists included Margarita Lam, Head of Media, Entertainment & Gaming at Point B; Deborah Newman, Grant Thornton’s Media & Entertainment Industry Leader; Ashok Parmar, Partner of Accounting and Reporting Advisory at Deloitte; and Scott Byrne, Executive Director of M&E at EY and was moderated by MFM President & CEO Joseph Annotti.

Below are a few highlights of the discussion.

What is the future of streaming?

Margarita Lam: I think the future of streaming is really bright. Why? If you look across the various dimensions, consumers have more content than they’ve ever had. With the launch of advertising-supported models, consumers will now have more ways to consume services at the price point they want. So for consumers, streaming is a win-win.

For media entertainment companies, streaming is a top strategic priority for the majority of them and now they have a direct relationship with that consumer. No longer do they have to go through a MVPD or through a theatrical chain to reach that consumer. They have all that data, they know exactly what things we’re interested in, whether it’s a cooking or travel show, and this will drive growth in their industry.

It’s a huge growth area for technology companies as well. Think of Amazon and Apple – why are they getting into the entertainment industry? And one of the main reasons is content is king and it engages the consumer to stay in their ecosystem.

Ashok Parmar: I think that the technology angle, even though content is king, is important. If you’re trying to find that movie or show to watch and you struggle after four or five clicks to find it’s a problem because our attention spans are so short.

The same content can be monetized multiple times in multiple ways with advertising or without advertising if the consumer wants to consume it. There’s an opportunity for some companies to focus on content and others to focus on technology.

How are NFTs going to change things and why? What are they and why should the financial and media executives in this room care?

Scott Byrne: First of all NFT stands for nonfungible token. It’s a digital asset and it is a unique digital asset. So think of it like it’s a Mickey Mantle baseball card from when he was a rookie, there are probably five of them that exist. There’s a limited market because first of all, it’s so expensive. And second of all, there are only 100 people in the world that are interested in buying them. NFTs are kind of like that. These are slivers of assets. They become more important as we talk about the metaverse, but my interpretation of the metaverse is that it’s like a big video game where you can buy components of it.

So from our perspective, how do you monetize that? How do you track that? We need to figure out how to value that. We do need to figure out how they’re used and how they transfer because we’re in finance and that’s our job. But I don’t believe that NFTs will be this frame-breaking category of things that are going to exist in the world. There’s going to be a subset of people that are interested in NFTs and then they’re going to go from there.

What are the major risks in the M&E industry? How have they changed?

Deborah Newman: So we’re living in unprecedented times. I view it as before COVID and after COVID because there are unique risks in the last two years. Companies in this industry are dealing with issues including if I physically show up to a sporting event or theater, right? What’s my liability? What’s my insurance? What are my protection protocols? All those kinds of things.

Margarita mentioned the strategy change with streaming going direct to consumers. We have more data now on consumers as we begin to roll out those models and there is a responsibility that we have with that data. What we see is companies really need to be aware of not only global regulations, but country-by-country, and state-by-state regulations. So for data, consumer data privacy started in California with CCPA and we now have five states with very robust consumer privacy acts. Some of them have similarities. So for example, if a consumer wants you to delete their data, they all have that, but they also have unique nuances. So you really need to have a team that stays on top of it. Because tomorrow’s regulations are not the same as today’s or yesterday’s. They’re literally constantly evolving and not only are there consumer privacy laws but there are employee privacy laws. So for example, there are multiple states that say, if you’re going to monitor someone’s email communications or their internet usage, they have to let the employees know. So companies also have to stay on top of that as part of their overall risk management.

The risk management umbrella is very broad and I also look at it for both brand and revenue protection. So when we think about any particular risk, it’s going to impact one or both of those things. I’m a big supporter also of enterprise risk management to stay on top of these things. But in particular, these regulations are what can get companies into trouble. And it’s not a matter of if it’s going to happen, it’s when, and if you are protected.